M&A Technical Due Diligence (Wells)

Services

Technical Due Diligence (Wells)

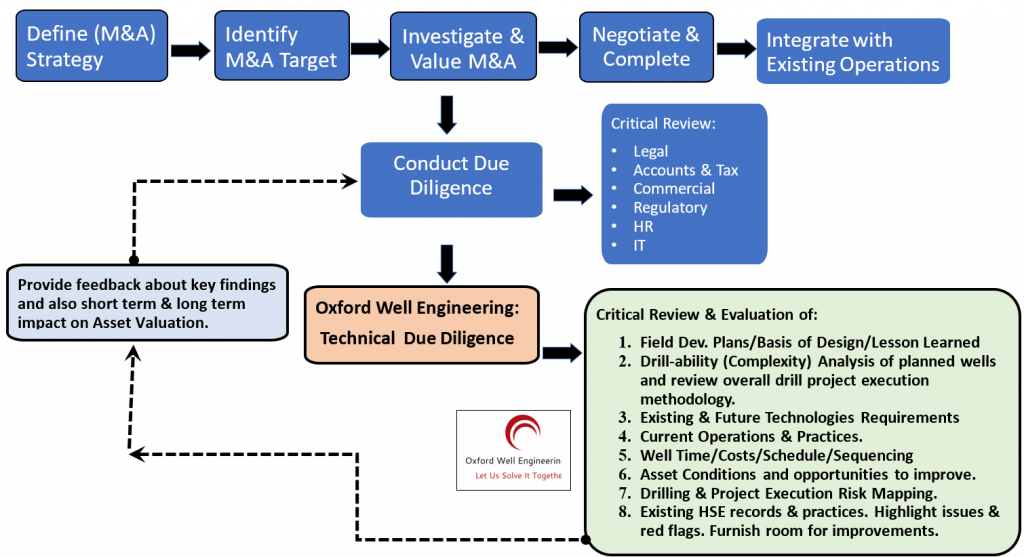

The Oil & Gas Mergers & Acquisitions (M&A) involve huge investments which is worthwhile due to M&A’s potential for delivering excellent growth for a company looking for a step-change.

Technical Due Diligence is an essential part of M&A, IF done right, it could bring an exponential growth & benefits for the buyers. On the other hand, if Due Diligence is not up to specifications, there are significant repercussions and depending upon severity, it could put buyers in deep financial problems. Oxford Well Engineering Team believes that there is no excuse for bad technical due diligence and it must be done right, very first time- full stop.

Due to criticality of technical work required, it is wise to use only the Subject-Matter-Experts (SME) to help portray true picture of Asset’s Technical Red Flags, Wells & Drilling Risks, Grey Areas & opportunities for growth.

As a part of Technical Due Diligence Process, Oxford Well Engineering Team could review & evaluate:

1. Field Development Plans/Basis of Design/Lesson Learned.

2. Drill-ability (Complexity) Analysis of planned wells and review of overall drill project execution plans.

3. Existing & Future Technologies Requirements.

4. Current Operations & Practices.

5. Wells Time/Costs/Schedule/Sequencing.

6. Asset Condition and Opportunities to improve.

7. Drilling & Project Execution Risk Mapping.

8. Existing HSE records & practices. Highlight issues & red flags. Furnish room for improvements.

Technical Due Diligence Work Flow & Deliverables

If you would like to learn more about how we could help, give us a call at our mobile 44+(0)7733994426 or at our Chiswick Office @ 44+(0)208 899 7460. Alternatively, contact us via email: naim@oxfordwellengineering.com.

Oxford Well Engineering Limited

Registered in England and Wales Company No. 11128312. Registered Address: Kemp House, 160 City Road, London, EC1 V2NX, UK VAT Registration No. 286321592